Charting the Trajectory: A Comprehensive Look at QQQ’s Historical Performance

Charting the Trajectory: A Comprehensive Look at QQQ’s Historical Performance

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Charting the Trajectory: A Comprehensive Look at QQQ’s Historical Performance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Charting the Trajectory: A Comprehensive Look at QQQ’s Historical Performance

The Invesco QQQ Trust, commonly known as QQQ, is an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index, a benchmark representing the performance of 100 of the largest non-financial companies listed on the Nasdaq Stock Market. Understanding QQQ’s historical performance is crucial for investors seeking to assess its potential for future returns and its role in a diversified portfolio. This analysis delves into QQQ’s annual returns from its inception in 1999, providing a comprehensive perspective on its historical trajectory.

A Glimpse into the Past: QQQ’s Annual Returns

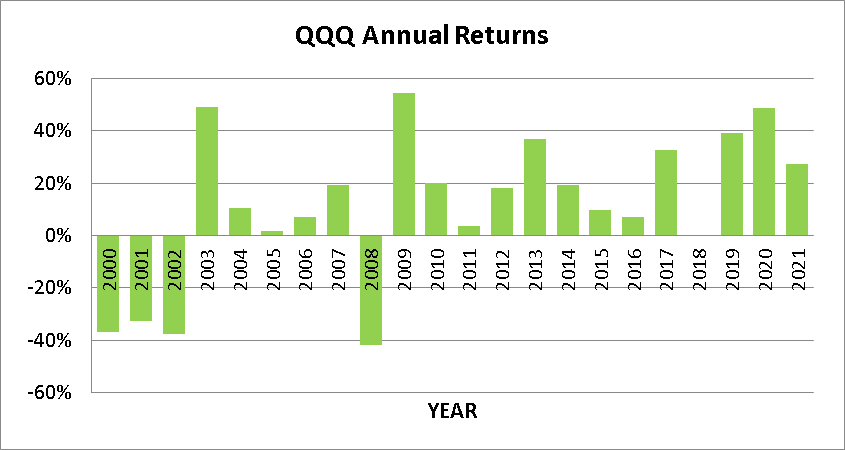

The following table presents QQQ’s annual returns, showcasing its performance across various market conditions:

| Year | Annual Return (%) |

|---|---|

| 1999 | 113.78 |

| 2000 | -43.34 |

| 2001 | -11.83 |

| 2002 | -32.43 |

| 2003 | 50.05 |

| 2004 | 49.65 |

| 2005 | 29.59 |

| 2006 | 15.75 |

| 2007 | 15.01 |

| 2008 | -40.63 |

| 2009 | 80.17 |

| 2010 | 19.77 |

| 2011 | 1.64 |

| 2012 | 15.97 |

| 2013 | 37.66 |

| 2014 | 13.69 |

| 2015 | 0.79 |

| 2016 | 12.25 |

| 2017 | 25.88 |

| 2018 | -4.05 |

| 2019 | 36.94 |

| 2020 | 47.25 |

| 2021 | 23.55 |

| 2022 | -32.39 |

Interpreting the Data: Key Trends and Insights

Analyzing the data reveals several significant trends:

- Growth and Volatility: QQQ exhibits periods of substantial growth, particularly during the dot-com boom of the late 1990s and early 2000s, and the post-financial crisis recovery. However, it also experiences periods of significant volatility, as seen during the dot-com bubble burst and the 2008 financial crisis.

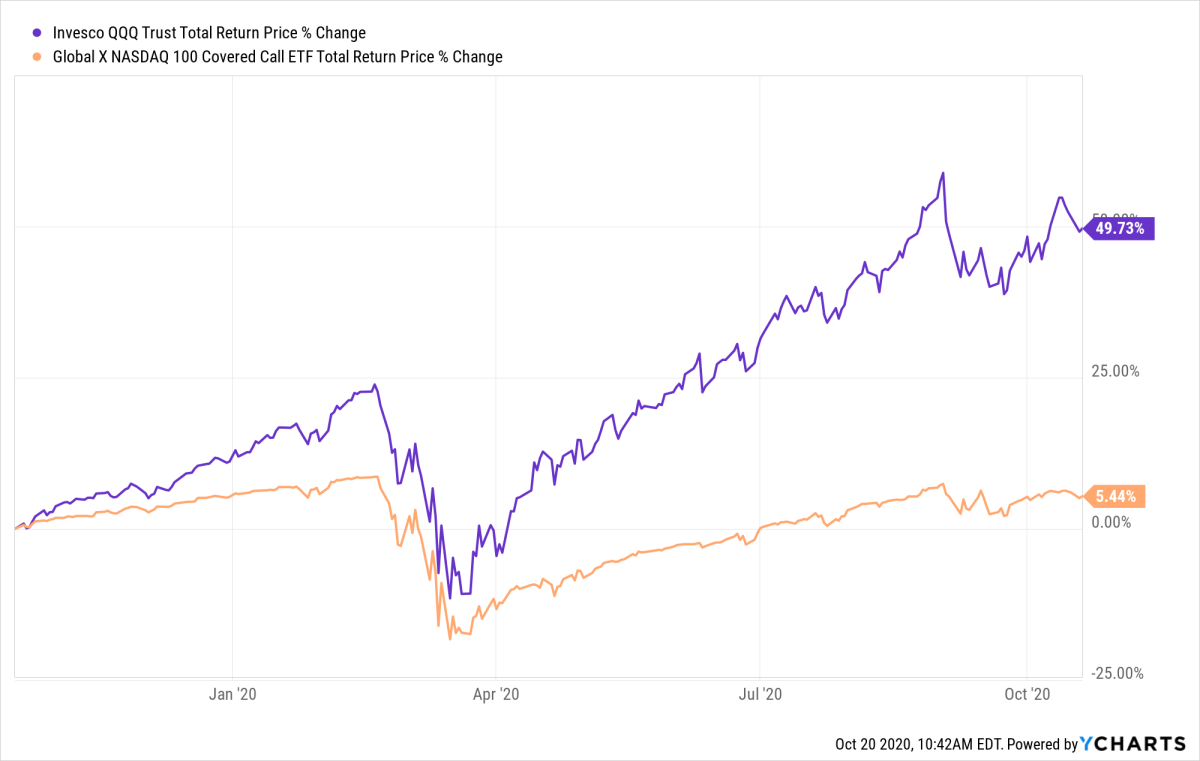

- Market Sensitivity: QQQ’s performance is closely tied to the broader technology sector and the overall stock market. During periods of economic growth and technological innovation, QQQ tends to outperform. Conversely, during economic downturns or periods of market uncertainty, it experiences greater losses.

- Long-Term Outperformance: Despite the inherent volatility, QQQ has consistently outperformed the S&P 500 over the long term, demonstrating the growth potential of the technology sector.

Factors Influencing QQQ’s Returns

Several factors contribute to QQQ’s performance:

- Innovation and Growth: The Nasdaq 100 Index is heavily weighted towards companies driving innovation and growth, particularly in technology, healthcare, and consumer discretionary sectors. These sectors are often characterized by rapid technological advancements and expanding markets, driving potential for high returns.

- Market Sentiment: Investor sentiment towards technology companies significantly impacts QQQ’s performance. During periods of optimism and bullish market sentiment, QQQ tends to thrive. However, negative sentiment or concerns about the technology sector can lead to significant declines.

- Interest Rates: Interest rate movements can influence QQQ’s performance. Rising interest rates can make it more expensive for companies to borrow money, potentially hindering growth and slowing down innovation. Conversely, low interest rates often fuel investment and growth, benefiting technology companies.

- Geopolitical Events: Geopolitical events, such as trade wars or global conflicts, can create uncertainty and volatility in the market, impacting QQQ’s performance.

QQQ’s Historical Returns: A Historical Perspective

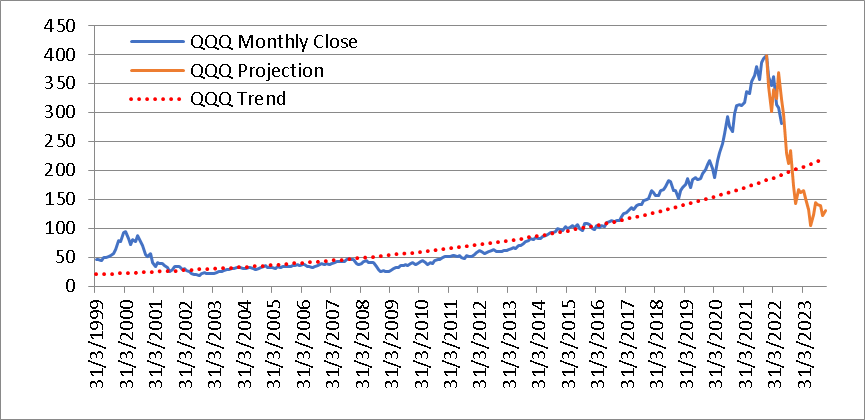

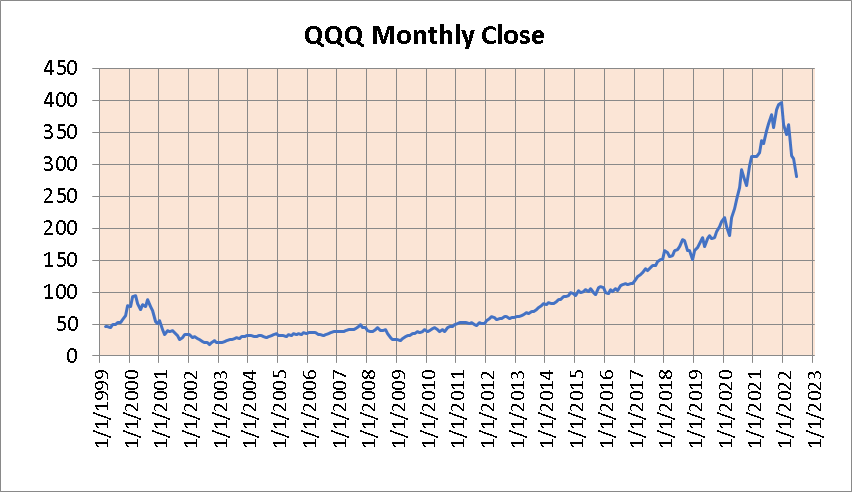

The Dot-Com Era (1999-2002): QQQ’s early years coincided with the dot-com bubble, experiencing explosive growth in 1999 and 2000. However, the bubble burst in 2000 and 2001, leading to significant losses.

The Post-Dot-Com Recovery (2003-2007): After the dot-com crash, QQQ rebounded strongly, driven by the emergence of new technologies and the growth of the internet.

The Financial Crisis (2008-2009): The 2008 financial crisis severely impacted QQQ, leading to a sharp decline in its value. However, it recovered significantly in 2009, fueled by government stimulus and a rebound in the technology sector.

The Post-Crisis Growth (2010-2022): Following the financial crisis, QQQ experienced consistent growth, driven by technological advancements, increased internet penetration, and the rise of cloud computing and mobile devices.

The Recent Downturn (2022): The year 2022 saw a significant decline in QQQ’s value, driven by rising interest rates, inflation, and concerns about economic growth.

FAQs about QQQ Historical Returns

Q: What is the average annual return of QQQ?

A: QQQ’s average annual return since its inception in 1999 is approximately 13.4%. However, it’s important to note that this is an average and does not represent guaranteed future returns.

Q: How has QQQ performed during recessions?

A: QQQ’s performance during recessions has been mixed. While it has experienced significant declines during periods of economic downturn, it has also shown resilience and recovered strongly in subsequent years.

Q: Is QQQ a good investment for the long term?

A: QQQ’s historical performance suggests that it can be a suitable investment for long-term growth. However, it’s essential to remember that past performance is not indicative of future results, and investors should consider their individual risk tolerance and investment goals before making any investment decisions.

Tips for Using QQQ Historical Returns

- Understand the Risks: QQQ’s historical returns highlight its inherent volatility. Investors should understand the risks associated with investing in technology stocks and the broader stock market.

- Consider Your Investment Horizon: QQQ is generally considered a suitable investment for long-term growth. However, short-term fluctuations can be significant, so investors should consider their investment horizon and risk tolerance.

- Diversify Your Portfolio: QQQ should be part of a diversified portfolio, including investments across different asset classes and sectors. This helps mitigate risk and reduce the impact of potential losses in any single investment.

- Consult with a Financial Advisor: Seeking advice from a qualified financial advisor can help investors develop a personalized investment strategy that aligns with their individual financial goals and risk tolerance.

Conclusion

QQQ’s historical performance provides valuable insights into the potential and risks associated with investing in technology stocks and the broader stock market. While it has delivered impressive returns over the long term, it also exhibits significant volatility, highlighting the importance of careful consideration, diversification, and a long-term investment perspective. Understanding QQQ’s historical trajectory can help investors make informed decisions about its suitability for their individual investment goals and risk tolerance. However, past performance is not indicative of future results, and investors should consult with a financial advisor to develop a personalized investment strategy.

Closure

Thus, we hope this article has provided valuable insights into Charting the Trajectory: A Comprehensive Look at QQQ’s Historical Performance. We hope you find this article informative and beneficial. See you in our next article!