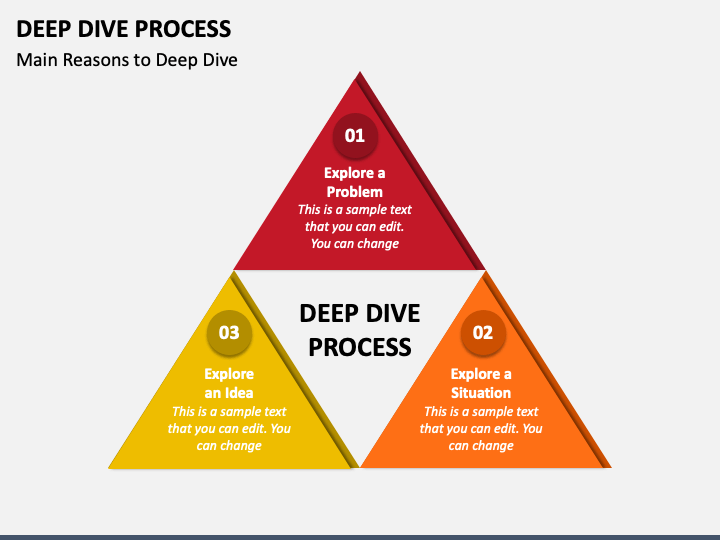

Navigating the 2026 Inventory Market Calendar: A Deep Dive into Alternatives and Challenges

The yr 2026 may appear distant, however for savvy buyers, it is already time to start out contemplating the panorama of the inventory market and the way particular calendar occasions can affect funding methods. Understanding the nuances of the 2026 inventory market calendar, together with earnings releases, financial knowledge bulletins, Federal Reserve conferences, political occasions, and even seasonal traits, can present a big edge in maximizing returns and mitigating threat. This text gives a complete overview of key calendar concerns for navigating the 2026 inventory market.

I. The Basis: Understanding the Fundamental Inventory Market Calendar

The inventory market operates on a constant schedule, offering a framework for buyers to plan their actions. Understanding this primary construction is essential for anticipating market actions and incorporating them into your funding technique.

- Buying and selling Days and Hours: The key inventory exchanges, such because the New York Inventory Trade (NYSE) and the NASDAQ, sometimes function Monday by Friday, excluding market holidays. The usual buying and selling hours are from 9:30 AM to 4:00 PM Jap Time (ET).

- Market Holidays: These are days when the inventory market is closed. Whereas the precise holidays can fluctuate barely from yr to yr, the widespread market holidays embody:

- New Yr’s Day

- Martin Luther King, Jr. Day

- Presidents’ Day

- Good Friday

- Memorial Day

- Juneteenth Nationwide Independence Day

- Independence Day (July 4th)

- Labor Day

- Thanksgiving Day

- Christmas Day

- Early market closures may happen the day earlier than or after sure holidays.

- Earnings Season: This can be a essential interval that happens 4 instances a yr, following the tip of every fiscal quarter (March, June, September, and December). Throughout earnings season, publicly traded corporations launch their monetary outcomes, offering insights into their efficiency and future outlook. This era is usually characterised by elevated market volatility as buyers react to the information.

- Financial Information Releases: Varied authorities businesses and personal organizations launch financial knowledge all year long. These releases, akin to GDP progress, inflation figures (CPI and PPI), unemployment charges, and client confidence indices, can considerably affect market sentiment and affect funding selections.

II. Key Calendar Occasions to Watch in 2026:

Past the essential framework, particular occasions in 2026 will seemingly form the inventory market panorama. These embody:

- Earnings Seasons (Q1, Q2, Q3, This fall):

- Impression: Earnings seasons are constantly essentially the most unstable durations. Firms that beat expectations typically see their inventory costs rise, whereas those who miss expectations can expertise vital declines.

- Technique: Buyers ought to rigorously analyze firm earnings experiences, being attentive to key metrics akin to income progress, revenue margins, and earnings per share (EPS). Ahead steerage offered by corporations can be essential for understanding future prospects. Diversification is essential to mitigating threat throughout this era.

- Federal Reserve Conferences:

- Impression: The Federal Reserve (Fed) performs an important function in influencing financial coverage. Its selections relating to rates of interest, quantitative easing, and different coverage instruments can have a profound affect on the inventory market.

- Technique: Intently monitor Fed bulletins and speeches. Take note of the Fed’s evaluation of the financial system and its outlook for inflation and employment. An anticipated price hike can result in a market downturn, whereas a price minimize can increase inventory costs. Understanding the Fed’s considering is paramount.

- Financial Information Releases:

- Impression: Financial knowledge releases present insights into the general well being of the financial system. Robust financial knowledge can increase investor confidence and drive inventory costs greater, whereas weak knowledge can have the other impact.

- Technique: Keep knowledgeable concerning the launch dates of key financial indicators. Perceive the implications of every indicator and the way it may have an effect on totally different sectors of the market. For instance, a powerful housing market can profit homebuilders and associated industries.

- Political Occasions:

- Impression: Political occasions, akin to elections, coverage modifications, and geopolitical tensions, can introduce uncertainty into the market.

- Technique: Whereas predicting political outcomes is troublesome, buyers can put together for potential market volatility by diversifying their portfolios and contemplating defensive shares. Sure sectors could also be extra delicate to political modifications than others.

- Geopolitical Occasions:

- Impression: Worldwide conflicts, commerce wars, and different geopolitical occasions can considerably affect international markets.

- Technique: Monitor geopolitical developments intently and assess their potential affect in your investments. Contemplate diversifying internationally to cut back publicity to particular regional dangers.

- Seasonal Developments:

- Impression: Traditionally, sure months and seasons have exhibited particular market traits. For instance, the "January impact" means that small-cap shares are inclined to outperform in January. The "Promote in Might and Go Away" adage means that inventory market returns are sometimes weaker throughout the summer time months.

- Technique: Whereas seasonal traits aren’t assured, they’ll present priceless insights for short-term buying and selling methods. Nonetheless, it is necessary to keep in mind that previous efficiency shouldn’t be indicative of future outcomes.

- Technological Breakthroughs and Disruptions:

- Impression: Main technological developments can create new funding alternatives and disrupt present industries.

- Technique: Keep abreast of rising applied sciences, akin to synthetic intelligence, blockchain, and renewable power. Determine corporations which can be well-positioned to profit from these traits.

- Inflationary Pressures and Curiosity Price Hikes:

- Impression: Persistently excessive inflation can drive central banks to lift rates of interest, which might negatively affect inventory valuations, significantly for progress shares.

- Technique: Contemplate investing in worth shares and dividend-paying shares, which are typically extra resilient in periods of rising rates of interest. Actual belongings, akin to actual property and commodities, may present a hedge in opposition to inflation.

- Provide Chain Disruptions:

- Impression: Continued provide chain disruptions can result in greater prices for companies and lowered financial progress.

- Technique: Determine corporations which have sturdy provide chain administration and are capable of mitigate the affect of disruptions.

III. Sector-Particular Concerns:

The affect of those calendar occasions will fluctuate throughout totally different sectors of the inventory market.

- Expertise: This sector is usually delicate to rate of interest modifications and financial progress. Technological breakthroughs and disruptions may have a big affect on particular person corporations and the sector as a complete.

- Power: The power sector is closely influenced by oil costs and geopolitical occasions.

- Healthcare: The healthcare sector is usually much less delicate to financial cycles, however it may be affected by authorities laws and coverage modifications.

- Financials: The monetary sector is closely influenced by rates of interest and financial progress.

- Shopper Discretionary: This sector is delicate to client spending and financial confidence.

- Shopper Staples: This sector is usually extra secure and fewer delicate to financial cycles.

IV. Creating a 2026 Funding Technique:

Based mostly on the calendar concerns mentioned above, buyers can develop a complete funding technique for 2026.

- Assess Your Threat Tolerance: Decide your consolation stage with threat and modify your funding technique accordingly.

- Diversify Your Portfolio: Diversification is essential to mitigating threat. Spend money on a wide range of asset courses, sectors, and geographic areas.

- Conduct Thorough Analysis: Earlier than investing in any firm, conduct thorough analysis and evaluation. Perceive its enterprise mannequin, monetary efficiency, and aggressive panorama.

- Keep Knowledgeable: Keep knowledgeable about market information, financial knowledge, and political occasions.

- Contemplate a Lengthy-Time period Perspective: Investing is a long-term recreation. Keep away from making impulsive selections primarily based on short-term market fluctuations.

- Rebalance Your Portfolio Recurrently: Rebalance your portfolio periodically to take care of your required asset allocation.

- Search Skilled Recommendation: In case you are uncertain about any facet of investing, search recommendation from a professional monetary advisor.

V. Instruments and Assets for Monitoring the 2026 Inventory Market Calendar:

Quite a few instruments and sources may help buyers observe the 2026 inventory market calendar and keep knowledgeable about key occasions.

- Monetary Information Web sites: Respected monetary information web sites, akin to Bloomberg, Reuters, and The Wall Avenue Journal, present complete protection of market information, financial knowledge, and firm earnings.

- Financial Calendars: Financial calendars, akin to these offered by Bloomberg and Foreign exchange Manufacturing facility, record the discharge dates of key financial indicators.

- Firm Investor Relations Web sites: Firm investor relations web sites present details about earnings releases, investor displays, and different necessary occasions.

- Brokerage Platforms: Many brokerage platforms provide instruments and sources for monitoring market information, financial knowledge, and firm info.

- Monetary Evaluation Software program: Software program akin to Bloomberg Terminal and FactSet present refined instruments for analyzing monetary knowledge and monitoring market traits.

VI. Conclusion:

Efficiently navigating the 2026 inventory market requires a proactive strategy and an intensive understanding of the calendar occasions that may affect market actions. By rigorously monitoring earnings releases, financial knowledge bulletins, Federal Reserve conferences, political occasions, and seasonal traits, buyers could make knowledgeable selections and maximize their returns whereas mitigating threat. Keep in mind that diversification, analysis, and a long-term perspective are important elements of a profitable funding technique. The 2026 inventory market, like every other, will current each alternatives and challenges. Preparation and information are the keys to navigating it successfully. Staying knowledgeable, adapting to altering situations, and sustaining a disciplined strategy can be essential for reaching your monetary objectives within the years to come back.

.png)