dow jones vs nifty chart dwell

Associated Articles: dow jones vs nifty chart dwell

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to dow jones vs nifty chart dwell. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Dow Jones vs. Nifty 50: A Reside Comparative Chart Evaluation

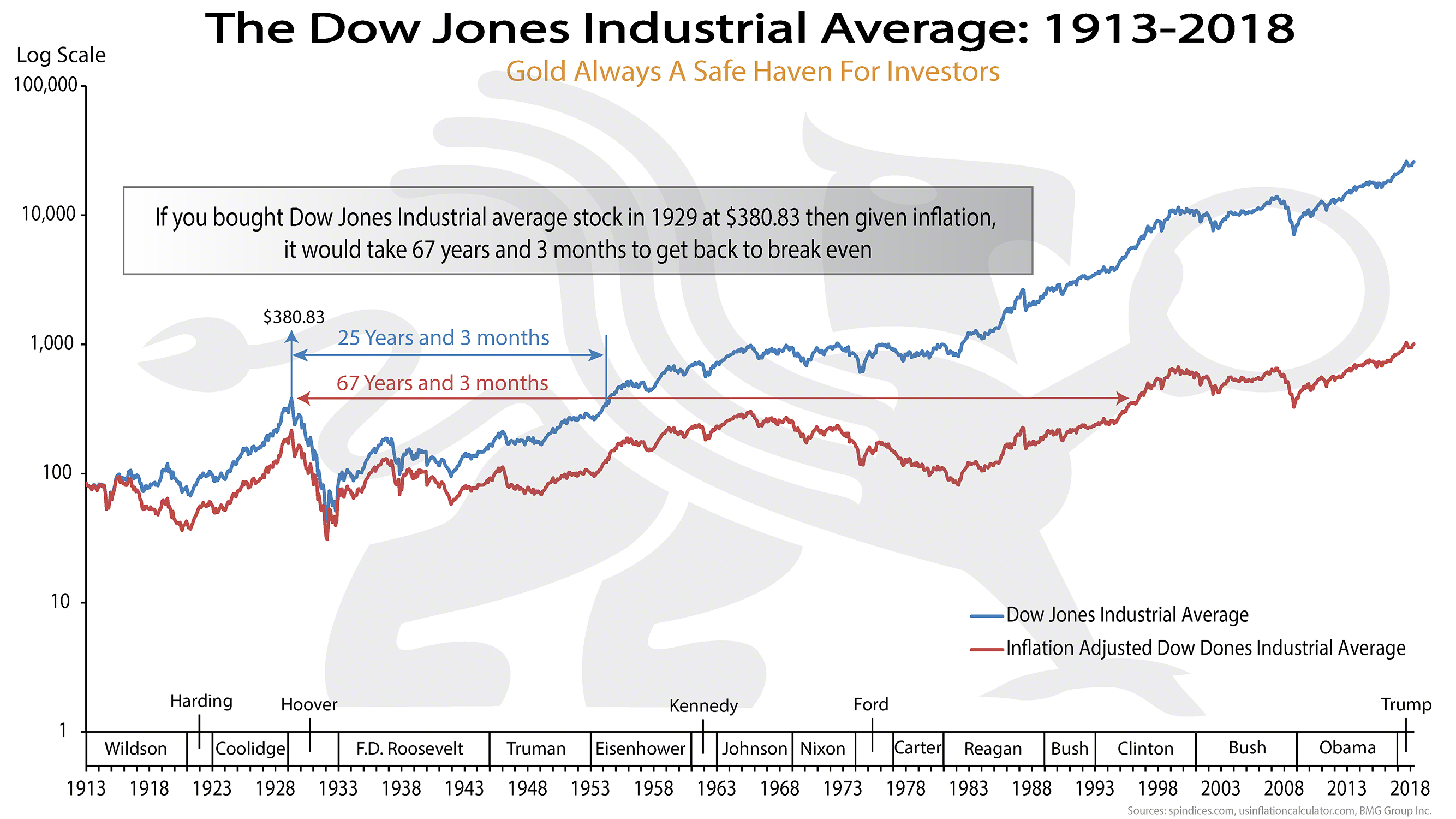

The worldwide monetary panorama is a fancy tapestry woven from the threads of quite a few inventory markets. Two outstanding strands on this tapestry are the Dow Jones Industrial Common (DJIA) and the Nifty 50 index, representing the USA and India, respectively. Whereas geographically distant and reflecting totally different financial realities, these indices usually exhibit correlated actions, but additionally diverge considerably at occasions. Understanding their relationship is essential for each seasoned traders and people simply beginning their journey on the planet of finance. This text will delve right into a comparative evaluation of the Dow Jones and Nifty 50, using a hypothetical dwell chart visualization (as a real-time chart is past the scope of this textual content) to spotlight their similarities, variations, and the components driving their interactions.

(Notice: The next evaluation makes use of hypothetical knowledge factors as an instance the ideas. Actual-time knowledge needs to be obtained from dependable monetary sources.)

Hypothetical Reside Chart Visualization:

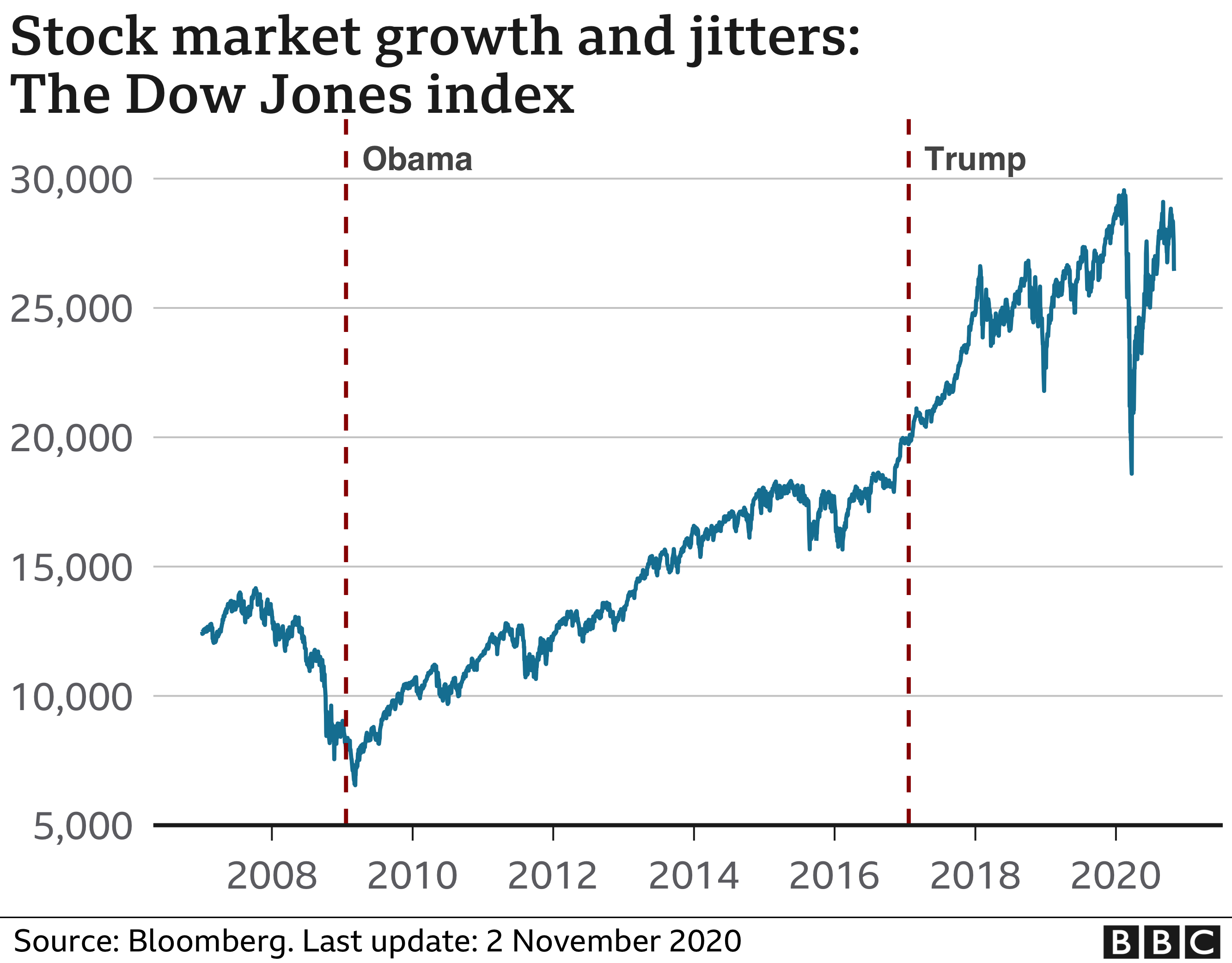

Think about a dual-axis chart. The left y-axis represents the Dow Jones Industrial Common (DJIA), whereas the appropriate y-axis represents the Nifty 50 index. Each axes show values over a selected timeframe, say the final yr. The chart would present two distinct traces, one for the DJIA and one for the Nifty 50, transferring independently but typically in tandem.

Similarities and Correlations:

Each the DJIA and Nifty 50 are main market indices reflecting the general well being of their respective economies. Their actions usually exhibit optimistic correlation, notably during times of world financial progress or decline. As an illustration, a optimistic international financial outlook, fueled by robust company earnings and elevated shopper spending, usually results in upward traits in each indices. Conversely, international recessionary fears or geopolitical uncertainties are inclined to push each downwards. This correlation stems from the interconnectedness of the worldwide economic system. Multinational companies listed in each indices are affected by related macroeconomic components like rate of interest adjustments, inflation, and commodity costs. Our hypothetical dwell chart would present intervals the place each traces transfer in the identical course, reflecting this synchronized conduct.

Nevertheless, the diploma of correlation varies considerably over time. Intervals of robust international synchronization will present a tighter correlation, whereas intervals of divergence will present a weaker and even unfavorable correlation. Elements influencing this variance embrace:

-

Sectoral Composition: The DJIA is closely weighted in the direction of know-how, industrials, and financials, whereas the Nifty 50 has a extra numerous composition, together with vital illustration from IT, banking, prescribed drugs, and shopper items. Sector-specific information or efficiency can result in divergence. For instance, a surge within the international tech sector may enhance the DJIA extra considerably than the Nifty 50 if the Indian IT sector would not expertise the same increase.

-

Geopolitical Occasions: Geopolitical occasions impacting one nation extra considerably than the opposite can result in divergence. For instance, a serious political upheaval in India may influence the Nifty 50 extra dramatically than the DJIA, even when international markets react negatively. Equally, US-centric occasions like commerce wars might have an effect on the DJIA extra immediately.

-

Home Financial Insurance policies: Differing financial and monetary insurance policies within the US and India may result in divergence. A major rate of interest hike within the US may negatively influence the DJIA greater than the Nifty 50, particularly if India maintains a extra accommodative financial coverage.

-

Foreign money Fluctuations: The change charge between the US greenback and the Indian rupee performs a vital position. A weakening rupee can negatively influence the Nifty 50’s efficiency in greenback phrases, even when the underlying Indian economic system is performing effectively. It is because international traders’ returns are affected by forex fluctuations.

Variations and Divergences:

Regardless of their occasional synchronized actions, the DJIA and Nifty 50 usually exhibit vital divergence. This divergence is highlighted in our hypothetical dwell chart by intervals the place the traces transfer in reverse instructions. A number of components contribute to this:

-

Financial Cycles: The US and Indian economies function on totally different cycles. The US economic system, being extra mature, may expertise slower however steadier progress, whereas the Indian economic system, being an rising market, may expertise intervals of fast progress interspersed with intervals of volatility. This distinction in financial cycles usually results in differing market performances.

-

Funding Sentiment: Investor sentiment in the direction of the US and Indian markets can differ considerably. Optimistic sentiment in the direction of rising markets may result in a surge within the Nifty 50, even when the DJIA stays comparatively stagnant. Conversely, unfavorable international sentiment may influence the Nifty 50 extra severely than the DJIA, as rising markets are sometimes seen as riskier investments.

-

Home Coverage Modifications: Important coverage adjustments in both nation can affect the respective index in a different way. As an illustration, main tax reforms or infrastructure improvement initiatives in India might positively influence the Nifty 50, whereas regulatory adjustments within the US might have an effect on the DJIA.

-

International Occasions: Whereas international occasions usually influence each indices, their influence can range relying on the particular occasion and the international locations’ publicity. For instance, a world pandemic may influence each markets, however the severity and period of the influence might differ primarily based on the respective international locations’ healthcare programs and financial responses.

Analyzing the Hypothetical Reside Chart:

Observing our hypothetical dwell chart, we might determine intervals of excessive correlation (each traces transferring collectively) and intervals of low correlation or divergence (traces transferring in reverse instructions). Analyzing the information and financial occasions throughout these intervals would assist perceive the underlying components driving these actions. For instance, a interval of excessive correlation may coincide with a world financial increase, whereas a interval of divergence may be related to a big coverage change in a single nation or a sector-specific occasion impacting solely one of many markets.

Conclusion:

The Dow Jones and Nifty 50, whereas usually exhibiting correlated actions, additionally show vital divergence. Understanding the components driving each similarities and variations is essential for knowledgeable funding selections. A comparative evaluation, utilizing real-time knowledge and contemplating macroeconomic components, geopolitical occasions, and sector-specific developments, permits traders to achieve a complete perspective on the worldwide monetary panorama and make extra strategic funding selections. Whereas a dwell chart gives a dynamic visualization of this relationship, cautious evaluation of the underlying financial and political components is crucial for correct interpretation and efficient decision-making. Bear in mind to at all times seek the advice of with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered helpful insights into dow jones vs nifty chart dwell. We thanks for taking the time to learn this text. See you in our subsequent article!